| Excerpt |

|---|

This article |

...

gives and explanation on how Seaman's Deduction option works in payroll. |

Background

Seaman's Deduction is the amount that crew taxable wages will be reduced by before the tax

...

withdrawal (Entry Code 901 Withholding tax by Table). This deduction is only applicable and available for Norwegian payroll companies.

Setup

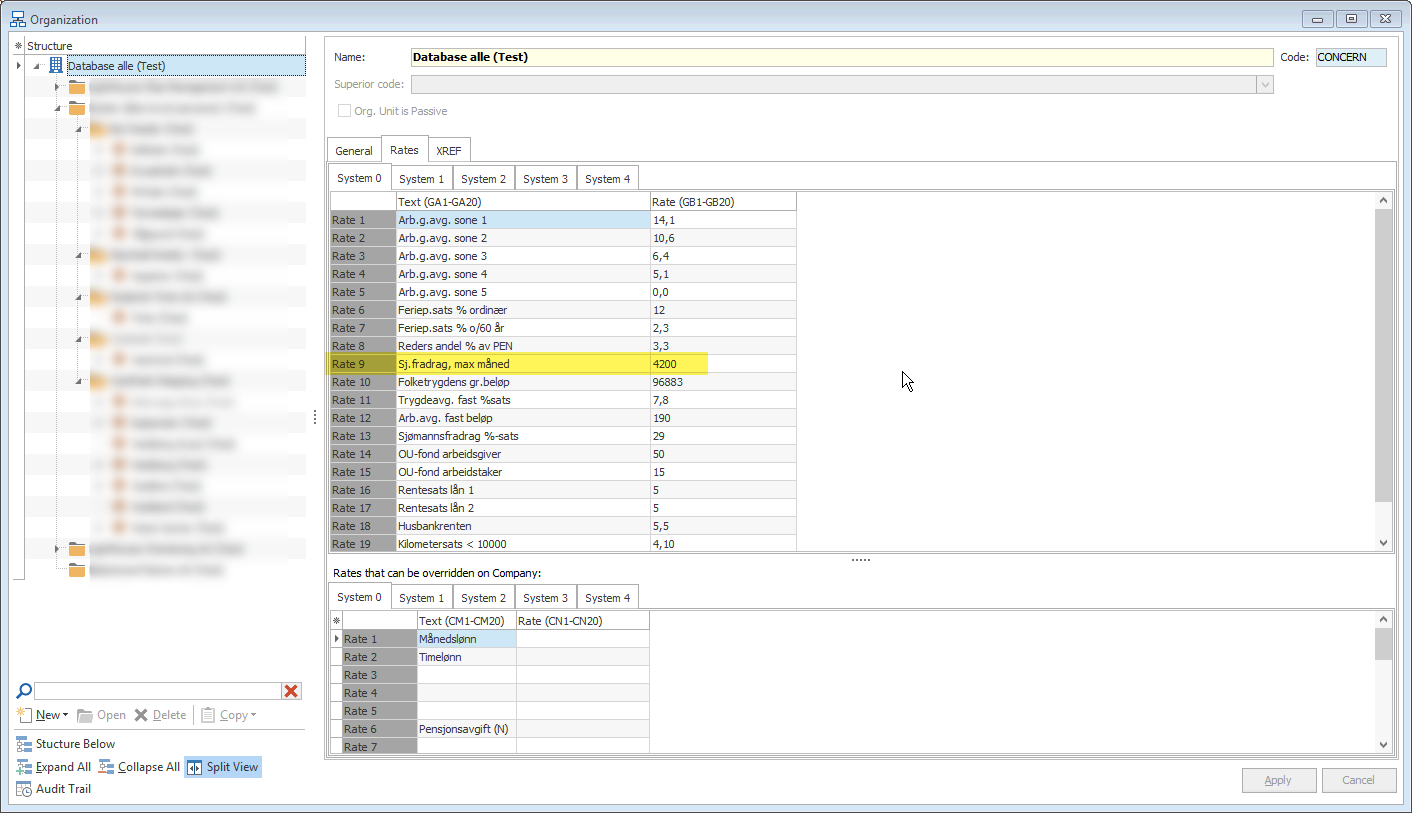

Add company max limit of seaman's deduction

...

per month on Global Rate 9.

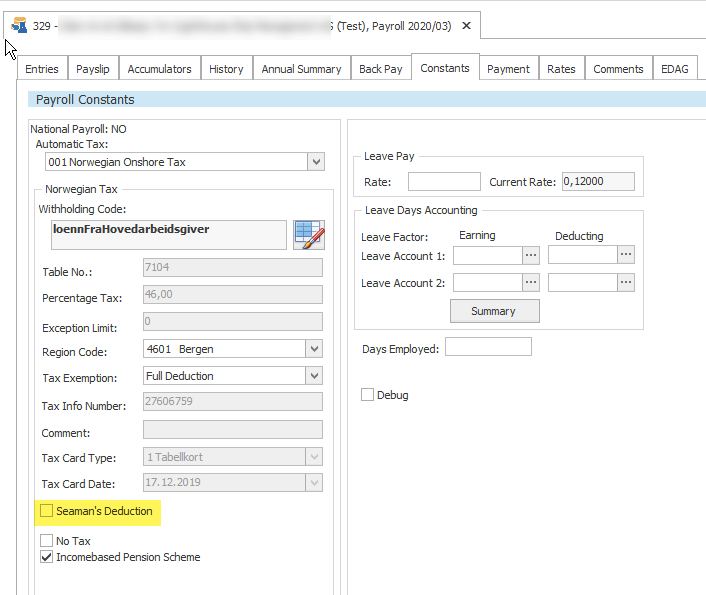

Enable Seaman's Deduction option on a person under the Constants tab.

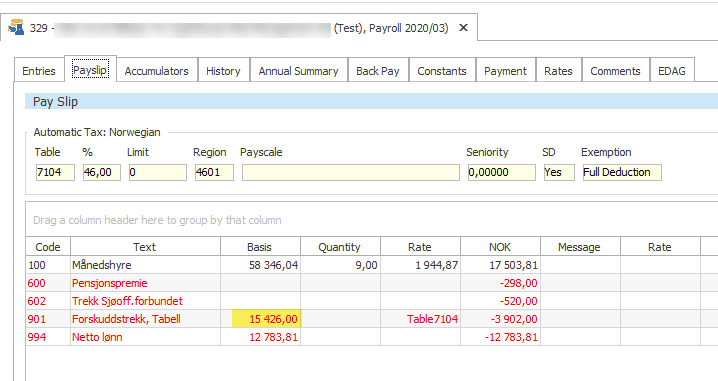

Recalculate and check the new calculation of basis for tax withholding. The system prorates the Global Rate 9 value per the number of tax days in the month (W80) and reduces the taxable wage by the found amount.

Example:

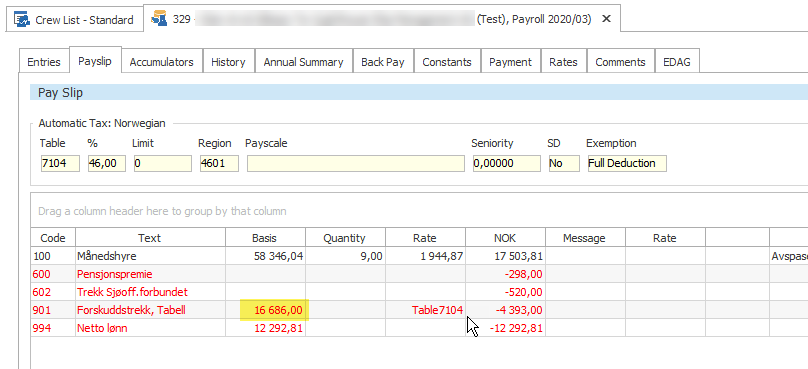

When the option is OFF, the taxable wages on a crew are NOK16686. Tax days in month = 9.

Enable option and recalculate. The amount of seaman's deduction should be 4200/30 * 9 = 1260. I.e. taxable wage 16686-1260=15426