...

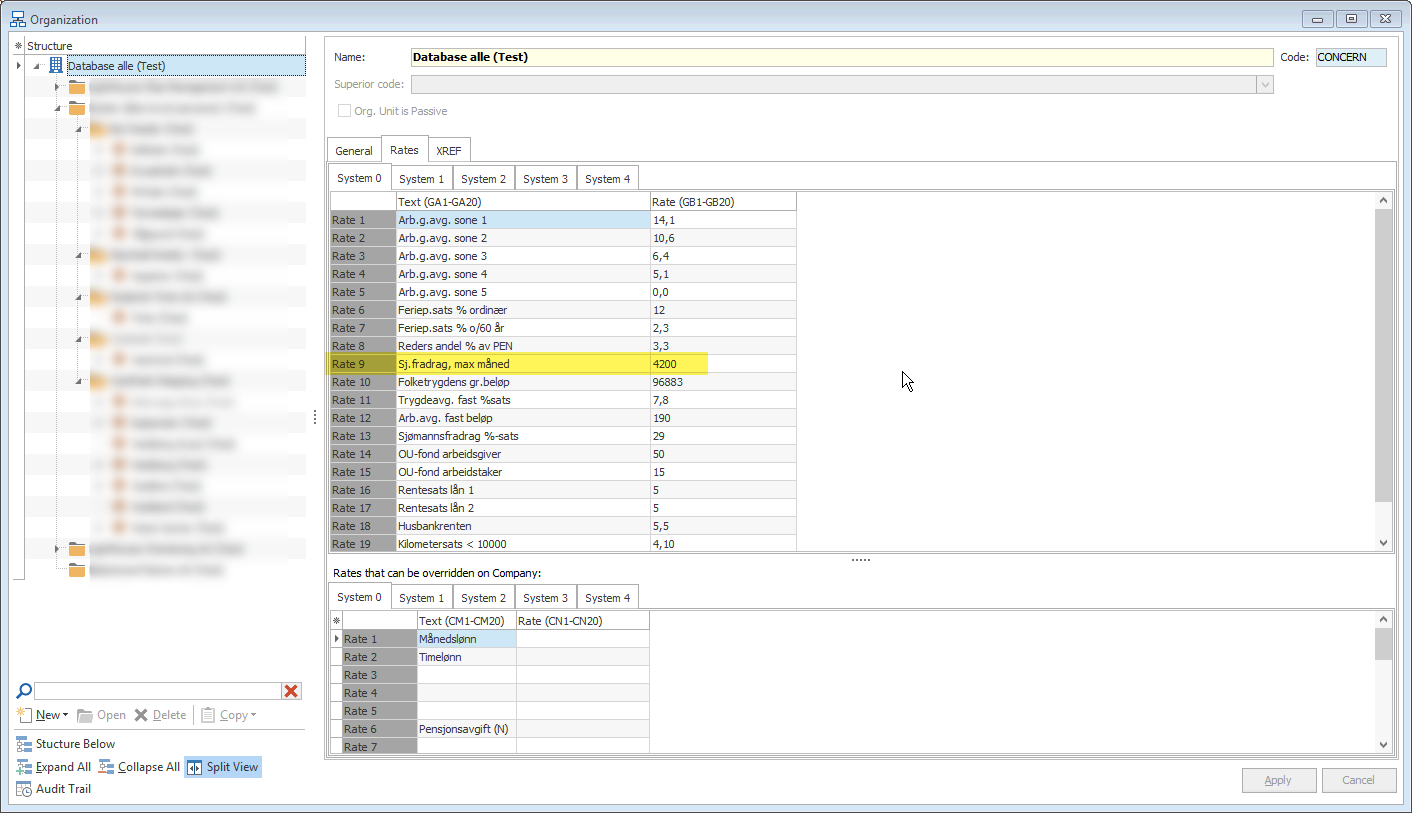

Add company max limit of seaman's deduction per month on Global Rate 9.

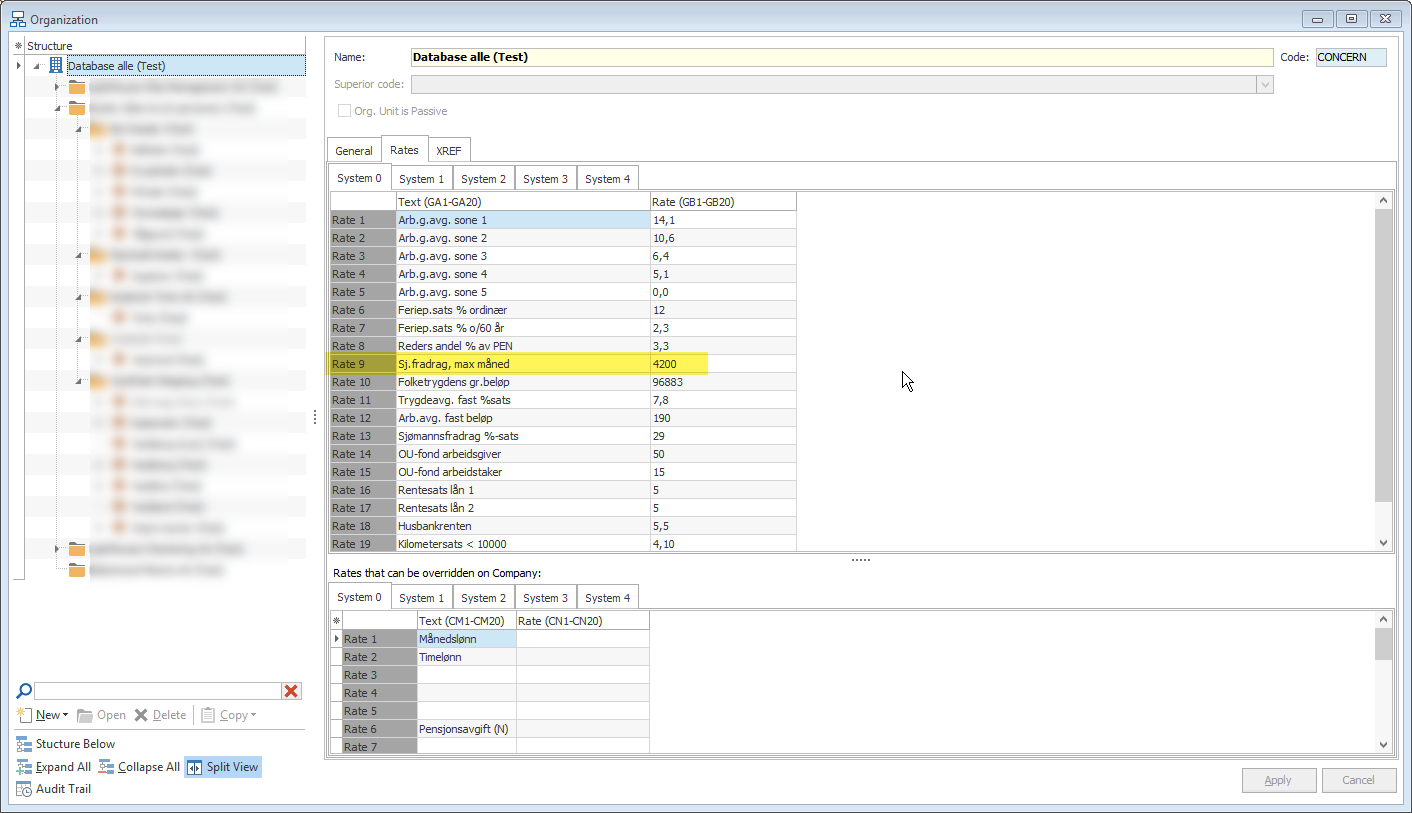

Enable Seaman's Deduction option on a person under the Constants tab.

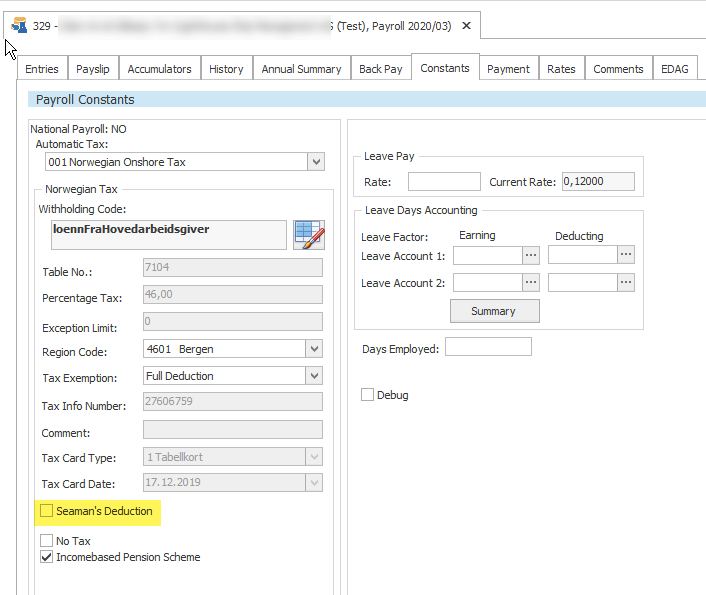

Recalculate and check the new calculation of basis for tax withholding. The system prorates the Global Rate 9 value per the number of tax days in the month (W80) and reduces the taxable wage by the found amount.

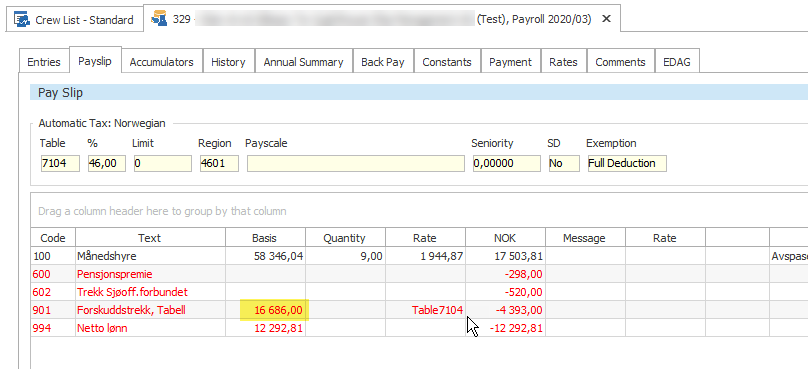

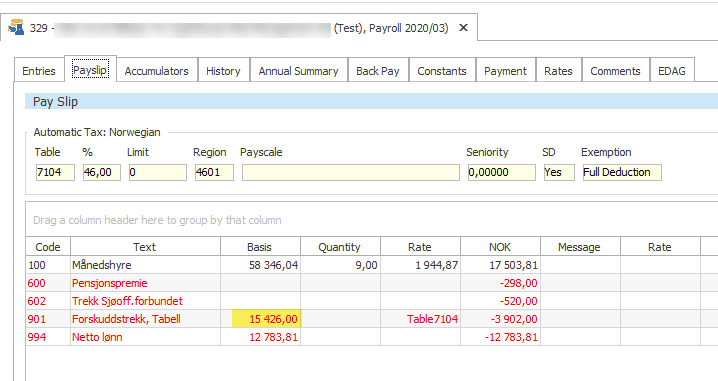

Example:

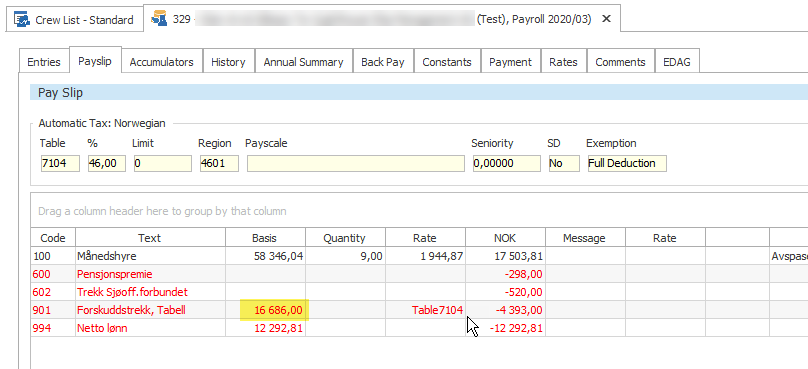

When the option is OFF, the taxable wages on a crew are NOK16686. Tax days in month = 9.

Enable option and recalculate. The amount of seaman's deduction should be 4200/30 * 9 = 1260. I.e. taxable wage 16686-1260=15426