| Table of Contents | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

| Excerpt |

|---|

This article explains the setup needed in Adonis Personnel Manager - APM, as well as the steps to take to generate a bank file of ISO 20022 format. |

| Table of Contents | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Description

ISO has provided a new standard scheme for the bank files. Many EU banks have already started using such scheme, however, ISO 20022 standard is quite flexible and the requirements to the accepted files can vary from bank to bank. Adonis currently introduced ISO 20022 format bank interface to BNP Paribas, Credit Suisse, Hellenic Bank, CFONB, Rabobank, Danske Bank.

...

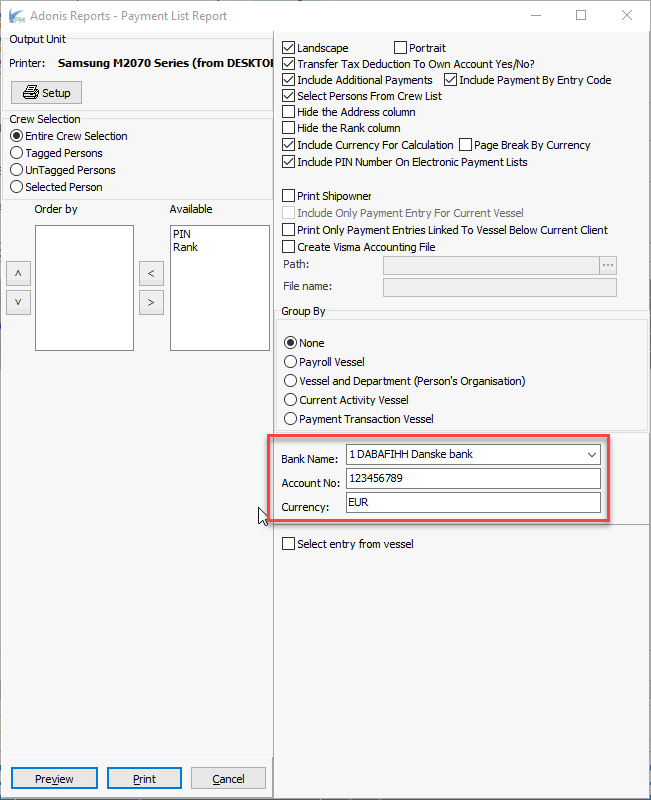

When all the calculations have been done and you need to produce the bank file for payment, go to Payroll > Reports > Current period reports and run either Advance list (to give advance bank transfer, works only with Entry Codes defined with option "Advance entry code") or Payment list (NetPay bank transfer) report depending on your needs. On the report dialog form select the payment bank account (your company bank account) and preview.

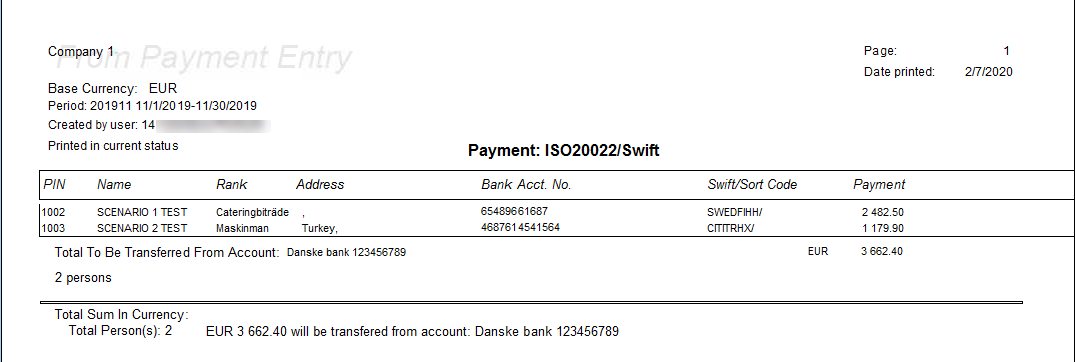

You will get an advance/payment list report listing each person netpay balance, name, rank, IBAN, receiver bank swift, etc. The balances from the report will be included into the bank file.

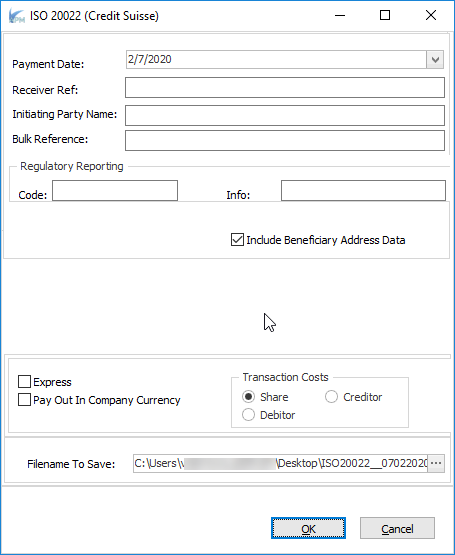

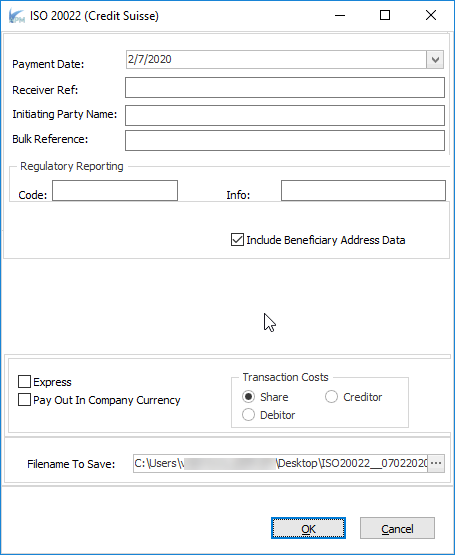

When you close the advance/payment list report ISO 20022 export window appears.

Payment Date - will be added into the bank file.

Receiver Ref, Initiating Party Name, Bulk Reference, Regulatory Reporting code and info are free input fields, not mandatory, also further included to the bank file.

Include Beneficiary Address Data - appears only for Credit Suisse type bank file to be excluded or included, with other bank formats beneficiary data is included into the file according to the bank specification.

Express - set "urgent" code for payment processing in the bank file.

Pay Out In Company Currency - converts all amounts in the bank file from person's payment currency into company currency (if different)

Transaction Costs - defines in the bank file who is paying bank charges for transaction costs. Creditor - Company, Debitor - Employee, Share - both.

Filename to save - allows to select the path to the folder where the file will be saved, the path is remembered by the system and will remain the same each time you run advance/payment list and ISO 20022 export. The file name by default receives date and time stamp.

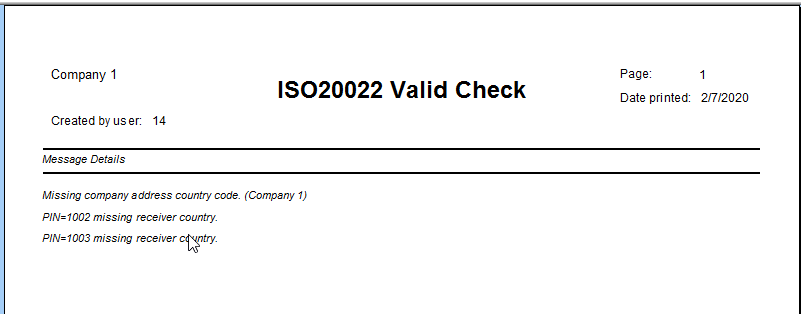

When file is exported successfully, you get an information message about it.We implemented ISO 20022 bank format validity check, so after the export, you get a Validity check report saying what PINs and what mandatory information is missing. If you get this report, most likely the bank file will be rejected without these data, you need to go back and add the missing details, recalculated the persons in question and generate the advance/payment list report and ISO 20022 export again to get the updated file.

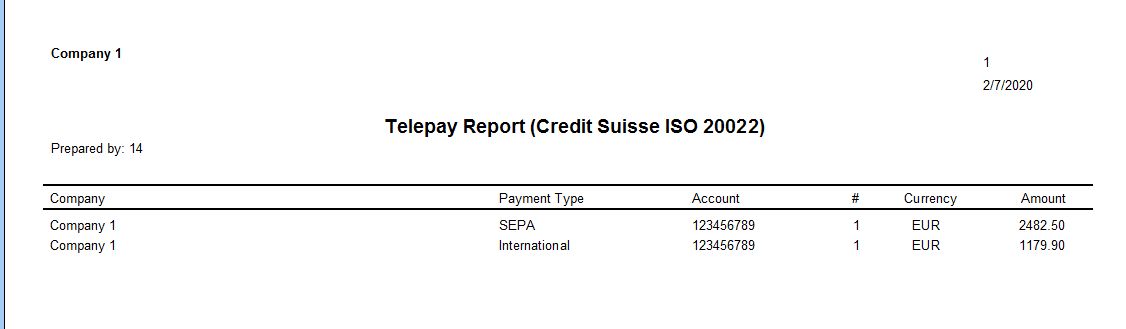

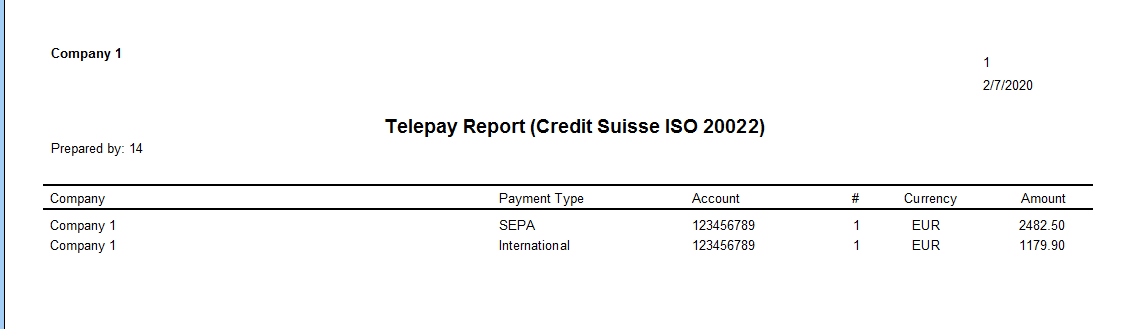

No matter is validity check report appears or not, then you will receive a Telepay report, which gives you information on how many SEPA and International payment type persons are included in the bank file and what amount goes by each payment type.