| Excerpt |

|---|

This article will explain how to create and setup a new Entry Code that has to be calculated as taxable benefit, i.e. increase the basis for tax calculation, but have no impact on net payment of employee. |

Step by step guide

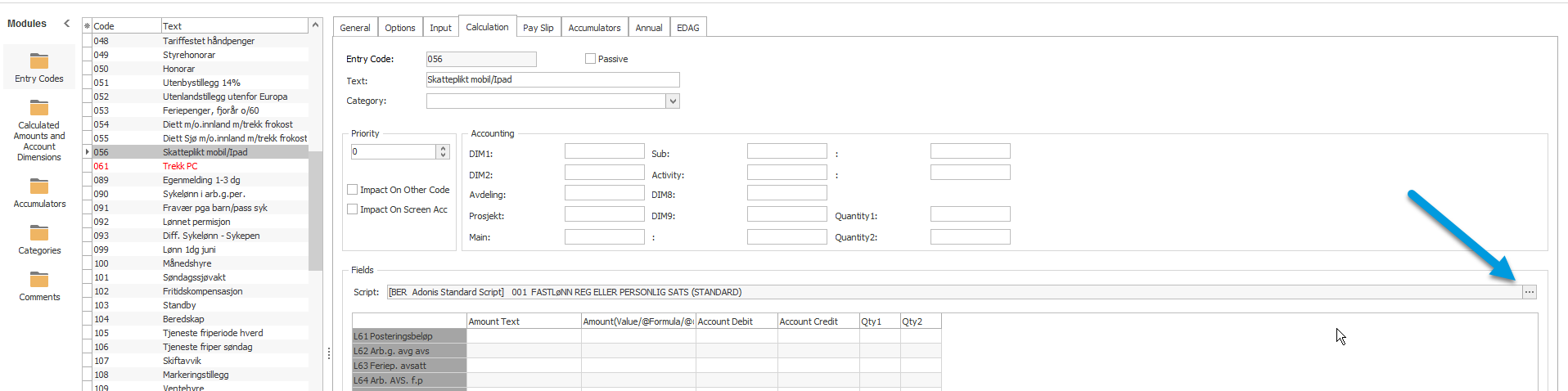

Go to Payroll > Entry Codes

...

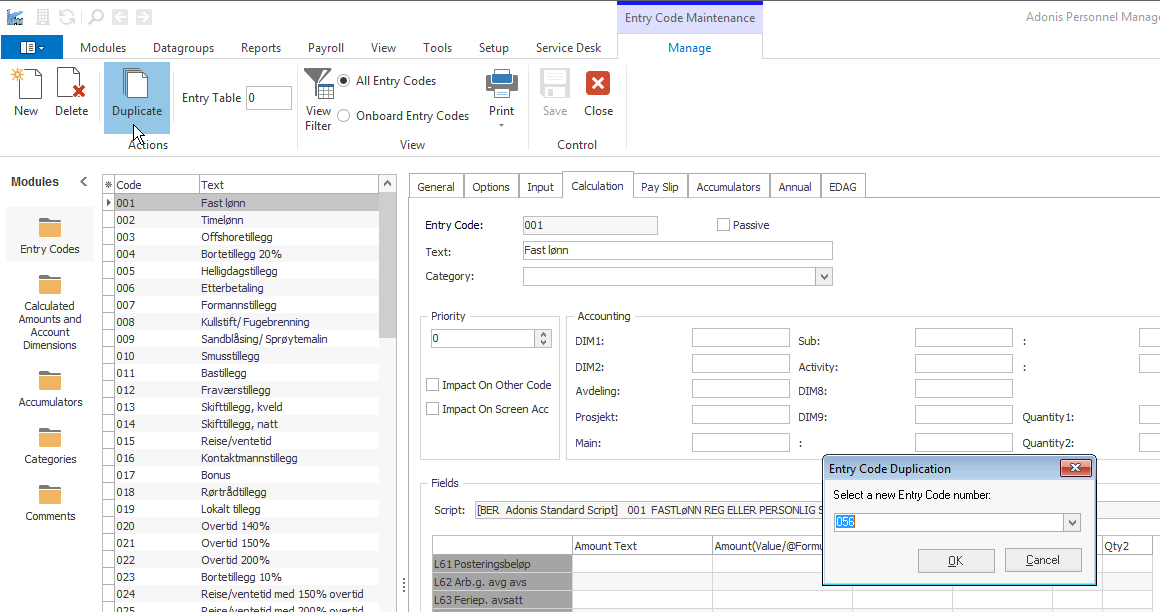

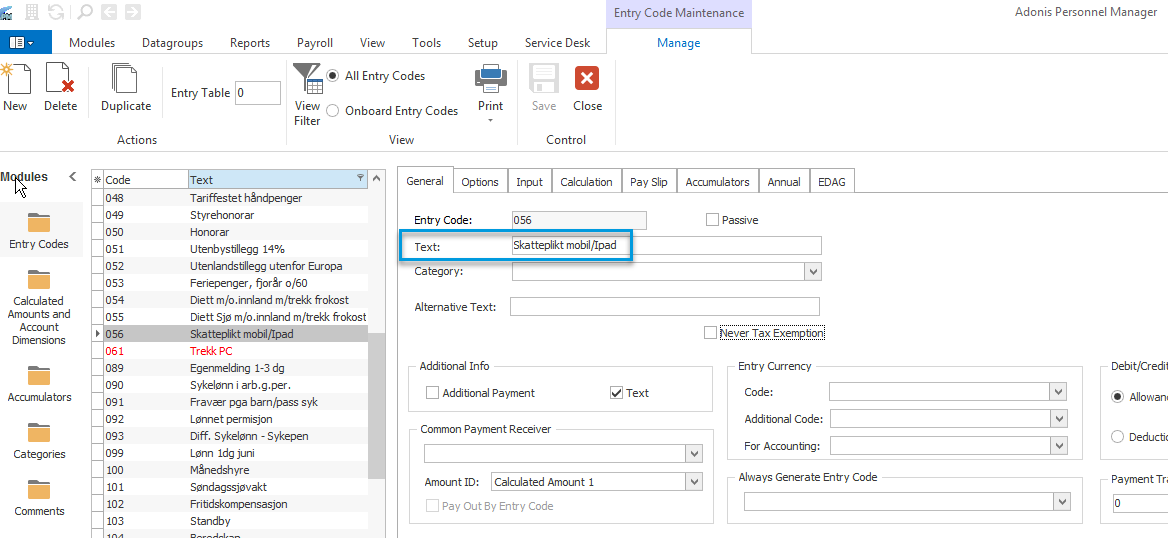

Create New or Duplicate and existing EC

...

...

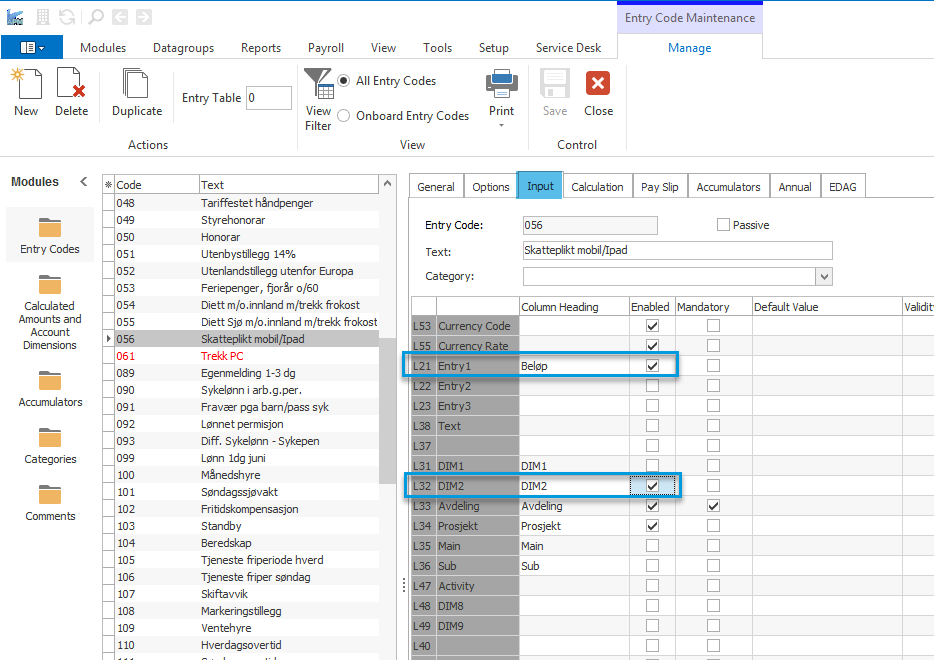

Enable Amount and Vessel fields on Input tabs settings. If required, enable other fields too.

...

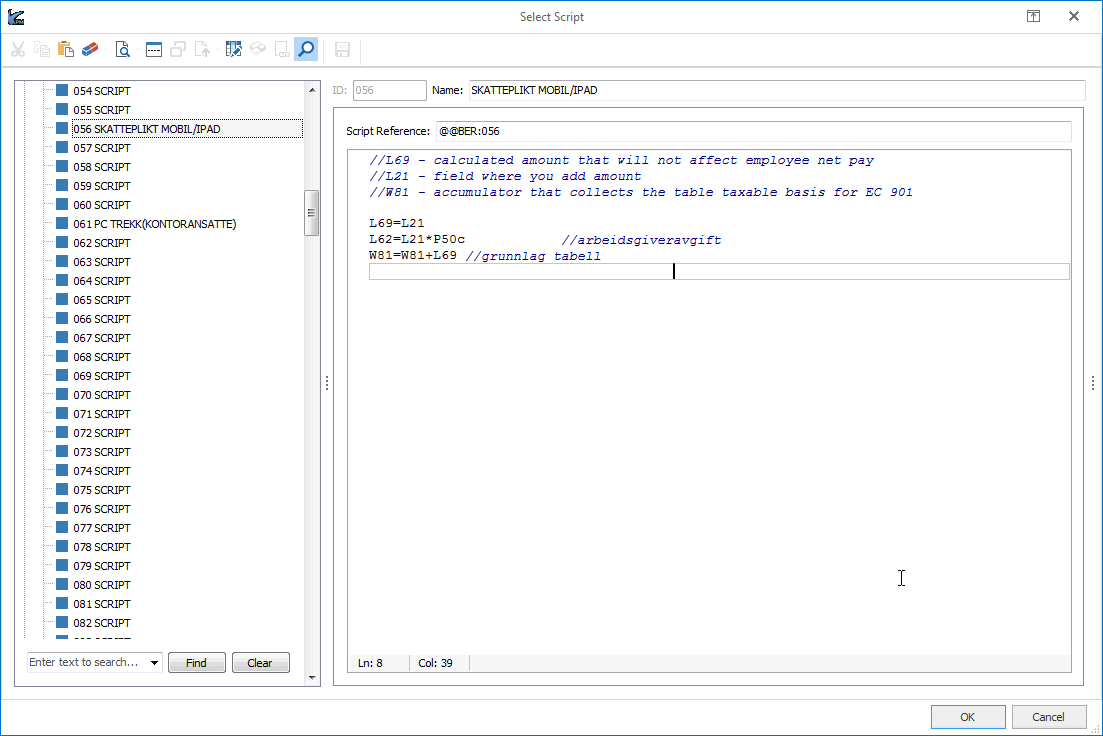

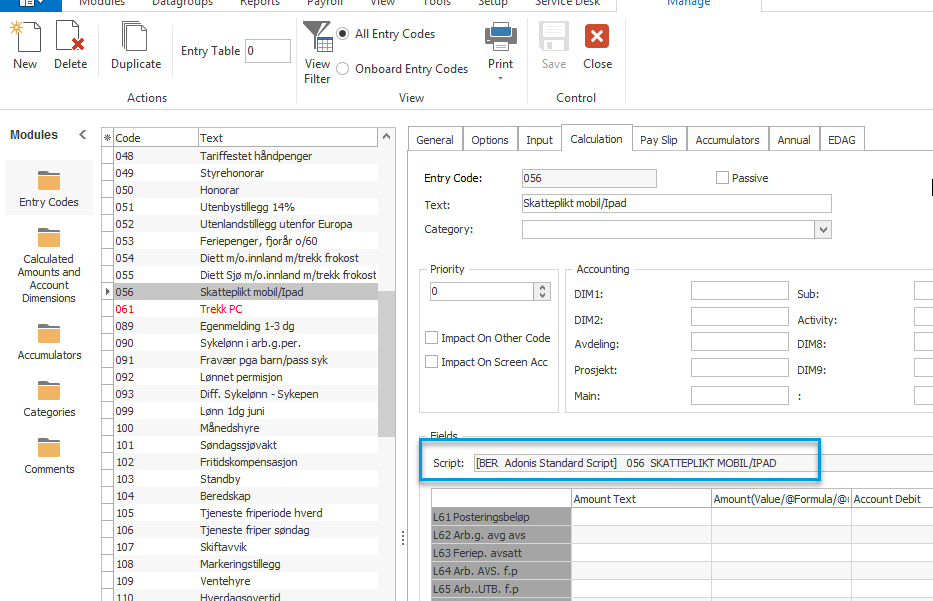

On Calculation tab link EC to script with the same number as EC number.

Add script lines as shown below.Panel borderColor #FF8D6B titleBGColor #009ADE title Script //L69 - calculated amount that will not affect employee net pay

//L21 - field where you add amount

//W81 - accumulator that collects the table taxable basis for EC 901L69=L21

L62=L21*P50c //arbeidsgiveravgift

W81=W81+L69 //grunnlag tabell

...

Warning The setup suggested in the payroll script here is applicable for Norwegian tax calculations only, is you are using another Tax Module, please contact Adonis support for advice on the payroll script.

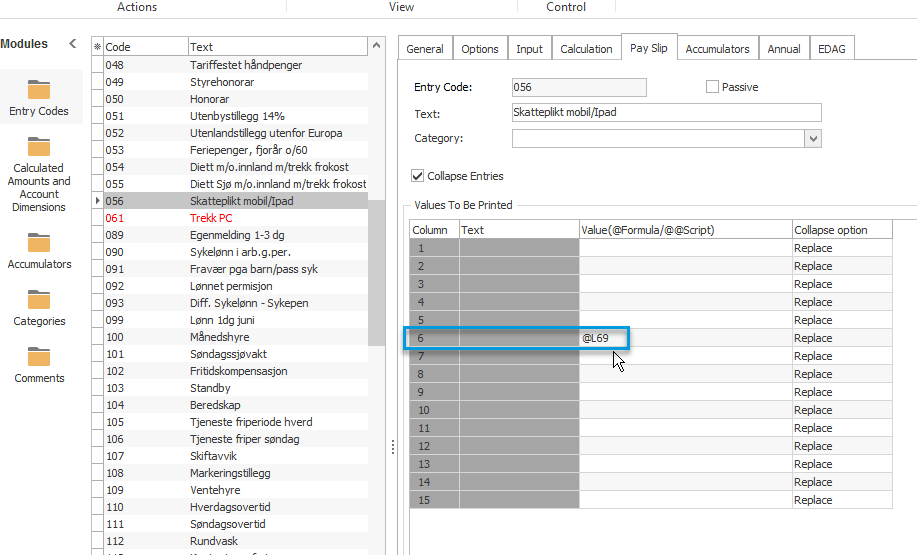

If you want to show the amount on the payslip, you may use the following settings on Payslip tab.

...

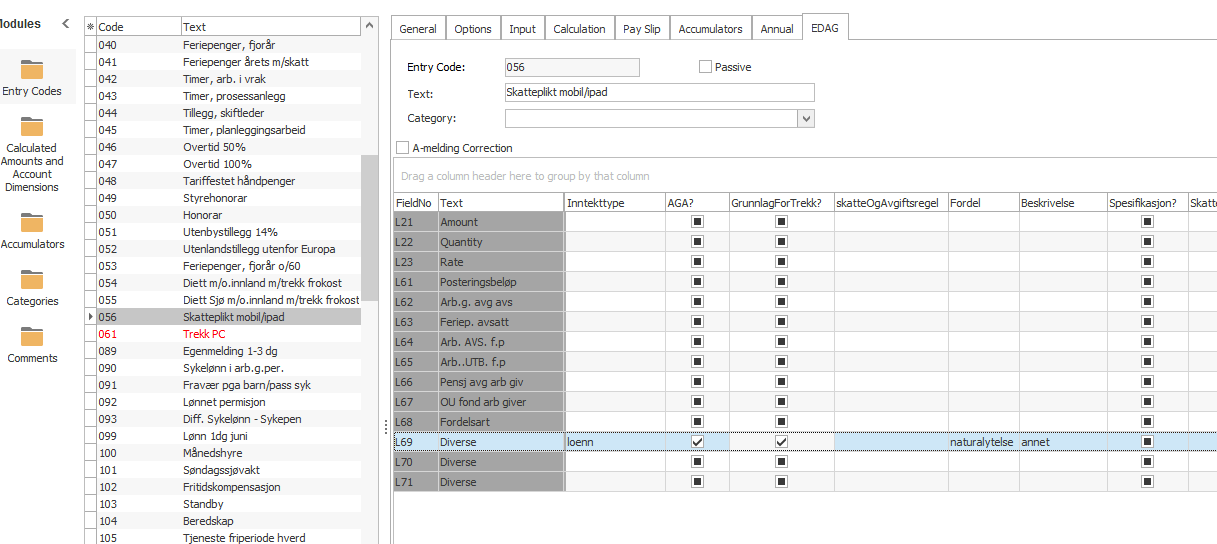

The Entry Code has to be reported to EDAG with coding lonn / naturalytelse annet, with yes for tax and AGA. No spesification needed.

...