This articles explains how to make the setup of UK Tax calculation for Norwegian Customers.

Entry Code Setup

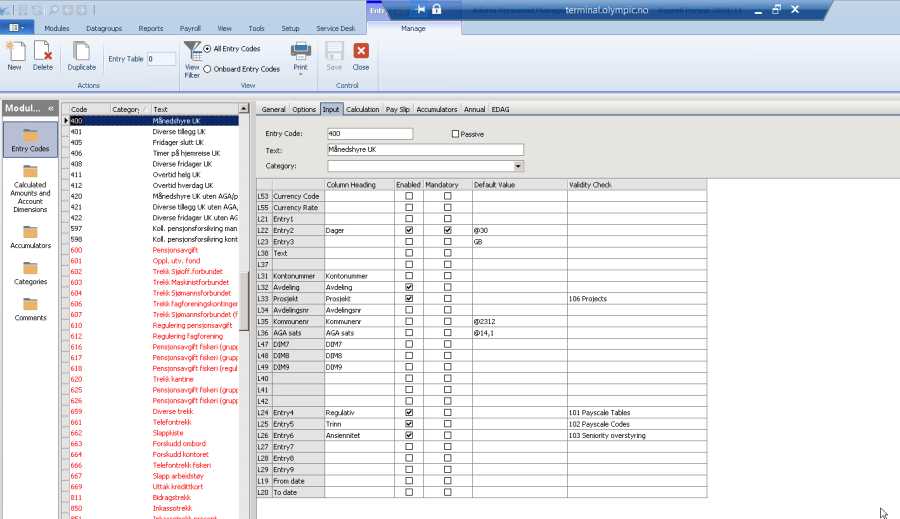

400 – Månedshsyre UK

1. Input tab

Should have the following configuration.

2. Calculation tab

Here we need to set the script for calculation. See Script section below.

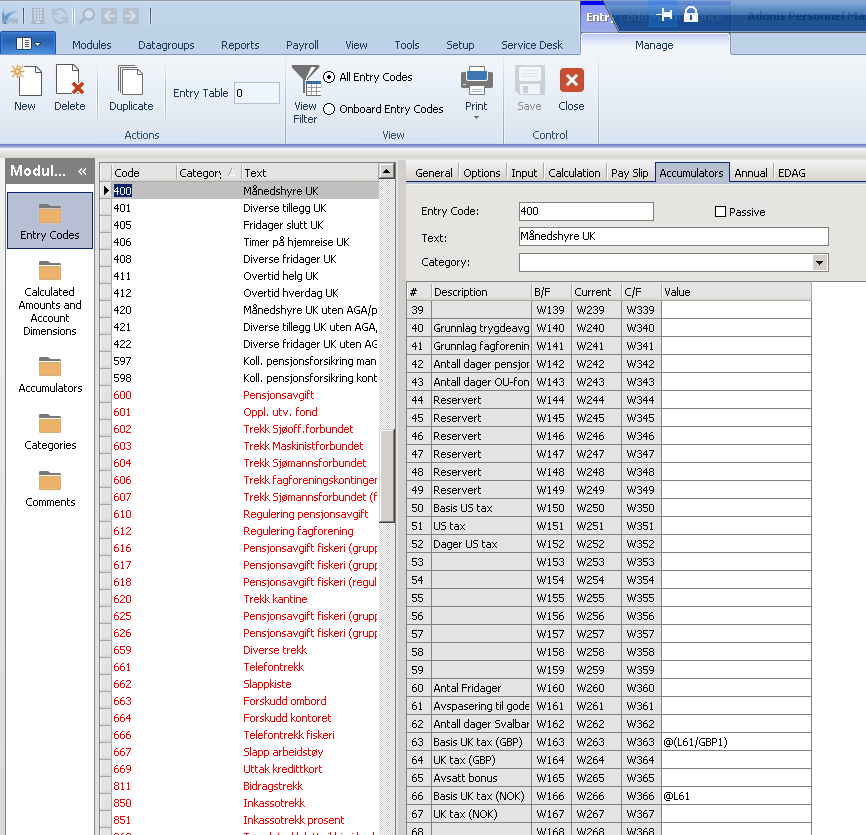

3. Accumulators tab

Should have the following configuration.

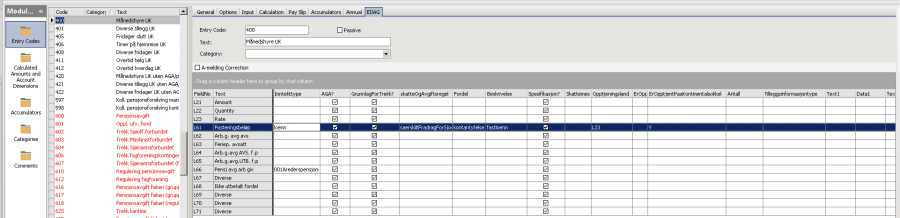

4. EDAG tab

886 - UK Tax korreksjon tidl. Skatteår

1. Input tab

No specific setup required.

2. Calculation tab

We need to create a script with this formula L61=L21.

Alternatively, instead of script, it is also possible to set a formula in L61 (Calculated amount 1) line: @L21.

3. Accumulators tab

No setup required.

4. EDAG tab

No setup required.

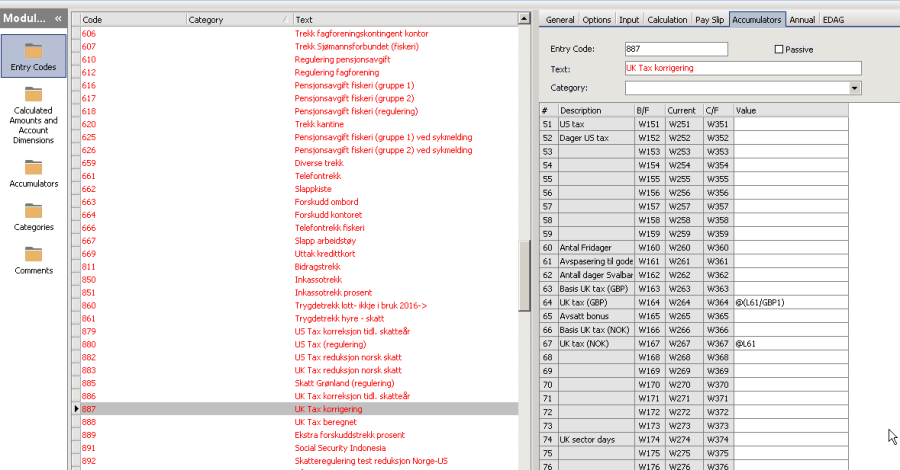

887 - UK Tax korrigering

1. Input tab

No specific setup required.

2. Calculation tab

We need to create a script with this formula L61=L21.

Alternatively, instead of script, it is also possible to set a formula in L61 (Calculated amount 1) line: @L21.

3. Accumulators tab

4. EDAG tab

No setup required.

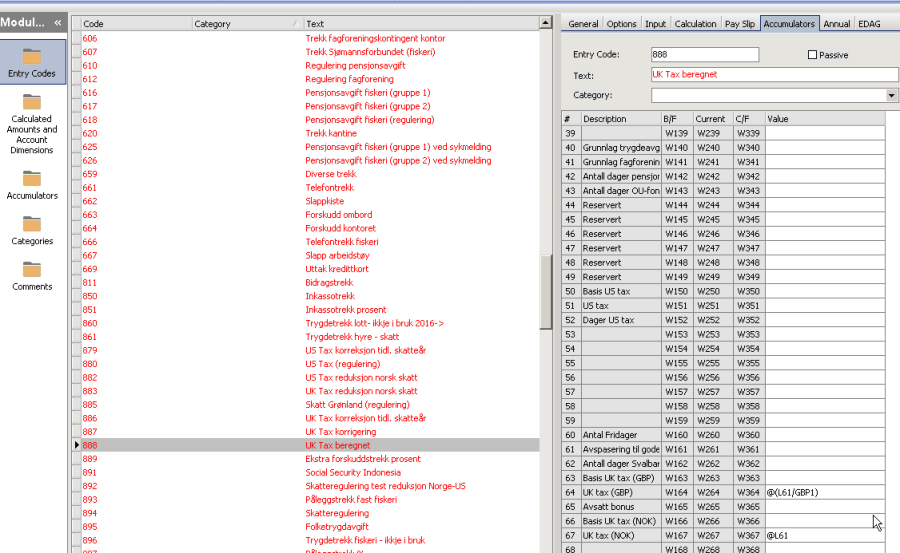

888 - UK Tax beregnet

1. Input tab

No specific setup required

2. Calculation tab

Here we need to set the script for calculation. See Script section below for your reference.

| Note |

|---|

Also note that this EC must have Priority higher than Basic Pay UK entry codes. |

3. Accumulators tab

4. EDAG tab

No setup required

| Anchor | ||||

|---|---|---|---|---|

|

Basic Pay UK

//Only if vessel is on UK location

IF L96a="UK" THEN

IF L11="Y" THEN //etterbetaling

L61=L21

ELSE

L61=((X1/30*L22)-((W219/30)*L22))+0,50 //posteringsbeløp

ENDIF

//Amounts and days are accumulating to different basises if there

//is an amount to be paid or deducted.

IF L61<>0 THEN

W40=W40+L61 //Grunnlag trygdeavgift, fast %-sats

W41=W41+L61 //Grunnlag kontingenttrekk

W42=W42+L22 //Dager pensjonsavgift

W43=W43+L22 //Antall dager OU-fond

W44=W44+L22 //Antall dager til diverse tillegg

W50=W50+L61 //Grunnlag inntektsbasert pensjon (PTS)

W80=W80+L22 //Dager for tabellvalg

W81=W81+L61 //Grunnlag tabell

W86=W86+L22 //Dager sjømannsfradrag

W87=W87+L61 //Grunnlag sjømannsfradrag

ENDIF

ENDIF

| Note |

|---|

Normally the above script would also include the calculations of the Norwegian employers fee, leave pay and pension. It should correspond to your company standards. |

UK Tax

L61=0

W64=W363-P363

W63=150000 //lower limit for 45% 2019-2020

IF W64 >= W63 THEN //45% TAX

L61=L61+((W64-W63) * 0.45) //45% tax above 150000

W64=W63 //reduce the top amount to the lower limit

ENDIF //45%TAX

W63=50001 //lower limit for 40% 2019-2020

IF W64 >= W63 THEN //40% TAX

L61=L61+((W64-W63) * 0.4) //40% tax above 46351

W64=W63 //reduce the top amount to the lower limit

ENDIF //40%TAX

W63=12501 //lower limit for 20% 2019-2020

IF W64 >= W63 THEN //20% TAX

L61=L61+((W64-W63) * 0.20) //20%

W64=W63 //reduce the top amount to the lower limit

ENDIF //20%TAX

L61=L61+W364-P364 //deduct the tax that has already been paid

L61=(L61*GBP1) + 0,5 //convert from GBP to base currency

L69=L61*(-1)

Fields Overview available for Payroll Scripts:

| Section | ||

|---|---|---|

| ||

P250 Tax Code for UK Tax P251 Month Week Basis for UK Tax P253 NI Number P254 UK Pay Rate P255 UK Pay Category P256 Tax Code Number (UK) P257 Num Period (UK) P258 Period No (UK) |

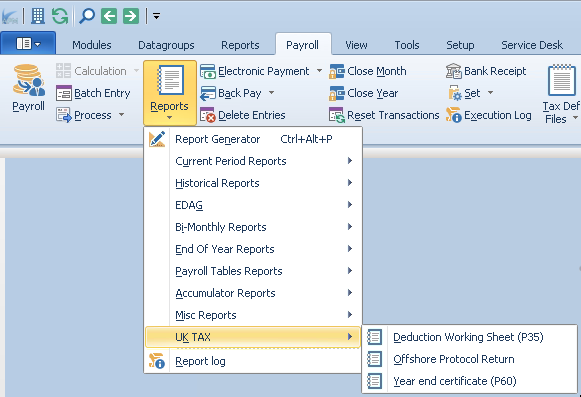

UK Tax Reporting

There are three different reports for UK Tax in the system. They are located under the Payroll > Reports > UK TAX.

| Note |

|---|

Corresponding access rights should be previously set in the Control Center > Reports tab for the appropriate user level to be able to view and run the reports. |

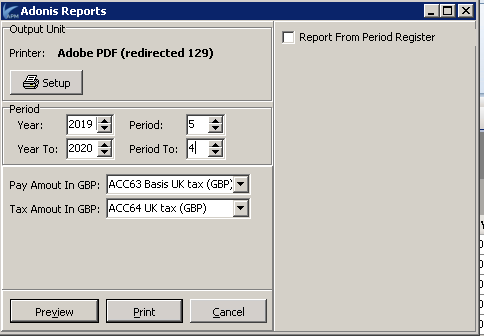

For each report it is possible to select the periods based on year and month, so that the report can be done from e.g. May 2019 until April 2020

The first time you use the report, the accumulators that holds the amount for Basic Wages in total, as well as the Total tax must be selected.

For each report, one also enters in the Employer Reference.

...

Deduction Working Sheet (P35)

This report will have one page for each employee, and show how much wages and tax were paid for each month with a total in the end.

...

Offshore Protocol Return

The report gives a summary, listing all persons in a table and with the total amount they have earned and how much tax is paid. All amounts are for the periods selected in the dialogue window.

...

Year End Certificate (P60)

This certificate is printed per person, and picks up the total amounts from accumulators and periods selected in the dialogue window.

...