...

The car allowance calculation is always usually based on the rates provided by the government.

...

Once the rates are in place, we need to create a payment transaction under the Payroll > Entry Codes.

...

| Expand |

|---|

| title | Car Allowance (regular) / KM-godtgjørelse (regular) |

|---|

|

| Info |

|---|

Note: In our setup, we use global rates 21 and 22 for the calculation.

But each customer can use different ones. |

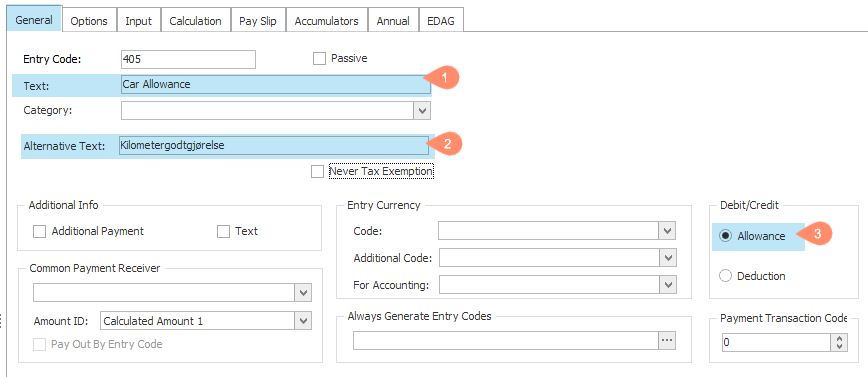

Under the General tab, fill in the entry Name and set it to Allowance.

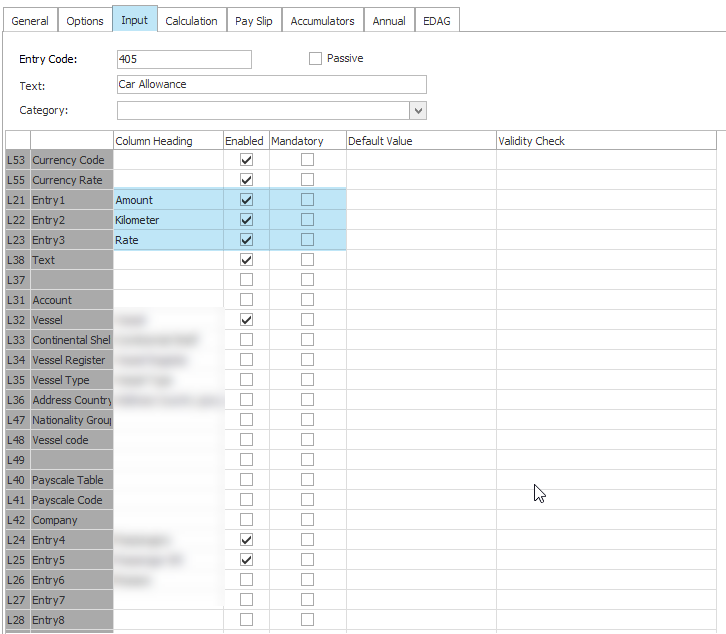

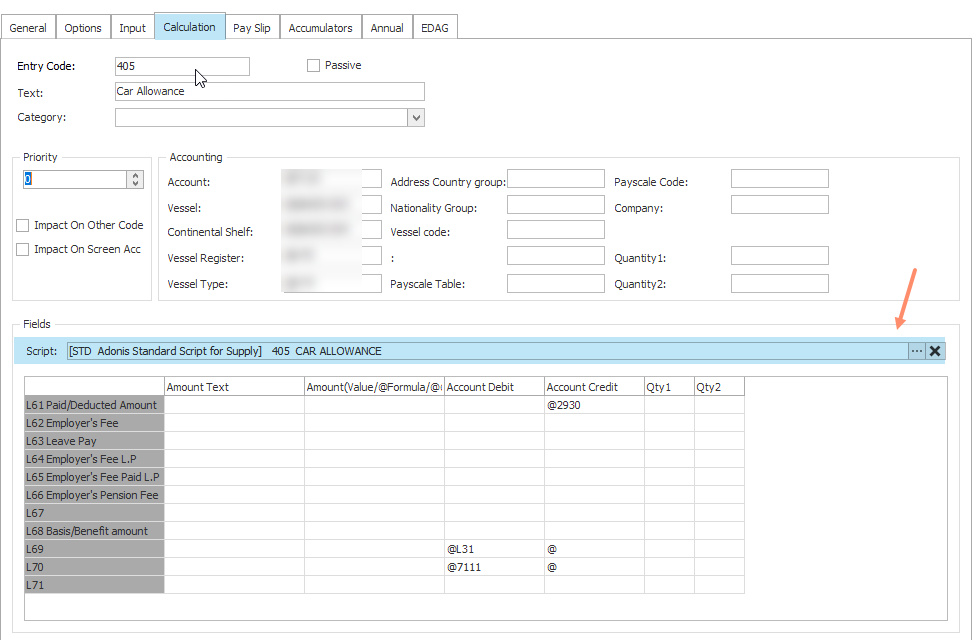

Under the Input tab, set up the following fields.  Under the Сalculation tab, define the necessary accounts and accounting dimensions.

In our example, the non-taxable amount is stored in L69, and the taxable amount is stored in L70.

Create a separate script for the Car Allowance calculation by clicking on the 3 three dots

This is an example of the script that you can create. Click here to learn more about the scripts.

In our case, we use global rates 21 and 22 for the calculation, and as mentioned, the non-taxable amount is stored in L69, and the taxable amount is stored in L70.

But you may use different ones.

| Code Block |

|---|

| //Setting Employer

//Here you need to add a line for calculating the employer organization

//e.g. @@ADD:007.

//You can check your other entries for

//L23 - Input field 3 used for Rate

//GB21 = Global rate line 21 for max rate

L23=GB21

//L61 - calculated amount 1

//L67 - calculated amount 7

//L22 - Input field 2 used for Kilometer

//L23 - Input field 3 used for Rate

//L21 - Input field 1 used for Amount

L61=L22*L23

L21=L61

L67=L21

//Calculation of taxable amount (Fordeling av skattepliktig beløp)

//GB22 = Global rate line 22 for non-taxable rate

//GB21 = Global rate line 21 for max rate

//(GB21-GB22) - taxable part

//L67 - calculated amount 7

//L69 - calculated amount 9

//L70 - calculated amount 10

IF GB21 > GB22 THEN

L70=(GB21-GB22) * L22

L69=L67-L70

ELSE

L70=0

L69=L67

ENDIF

//L62 - calculated amount 2

//W81 - accumulator for tax table

//P50c - Company rate for region

W81=W81+L70 //Taxable (Skattepliktig)

L62=L70*P50c //Employers fee |

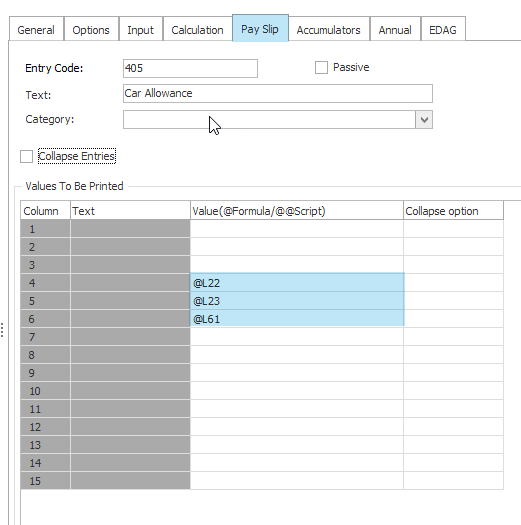

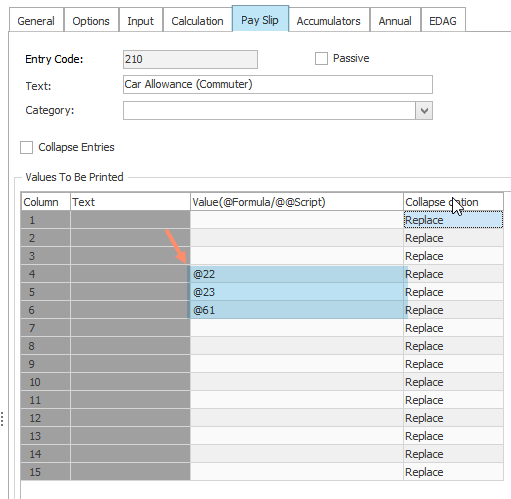

Setup the fields to be available on the Payslip.

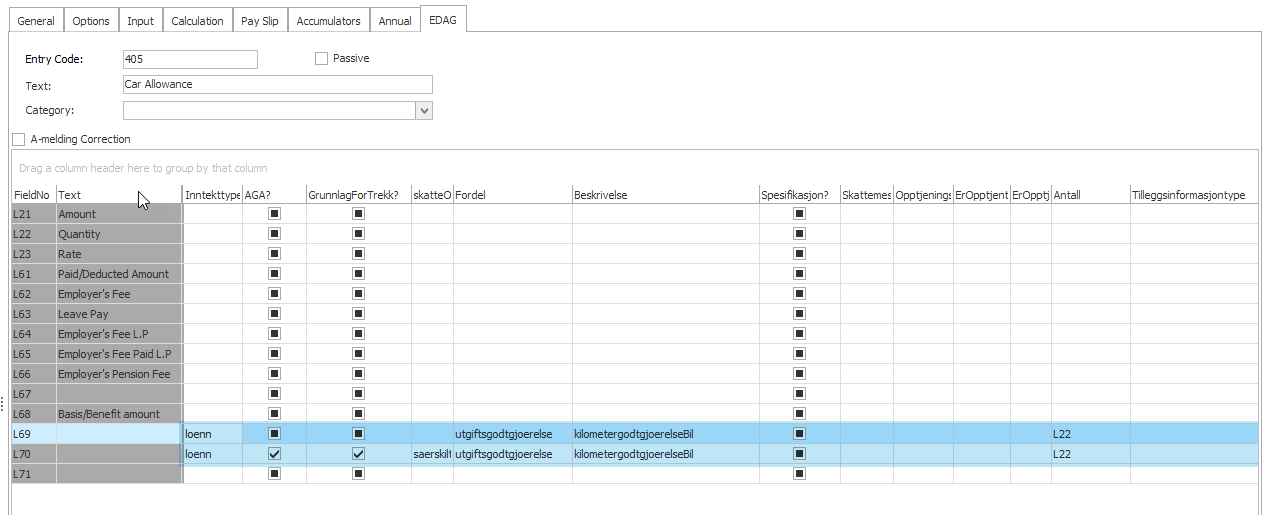

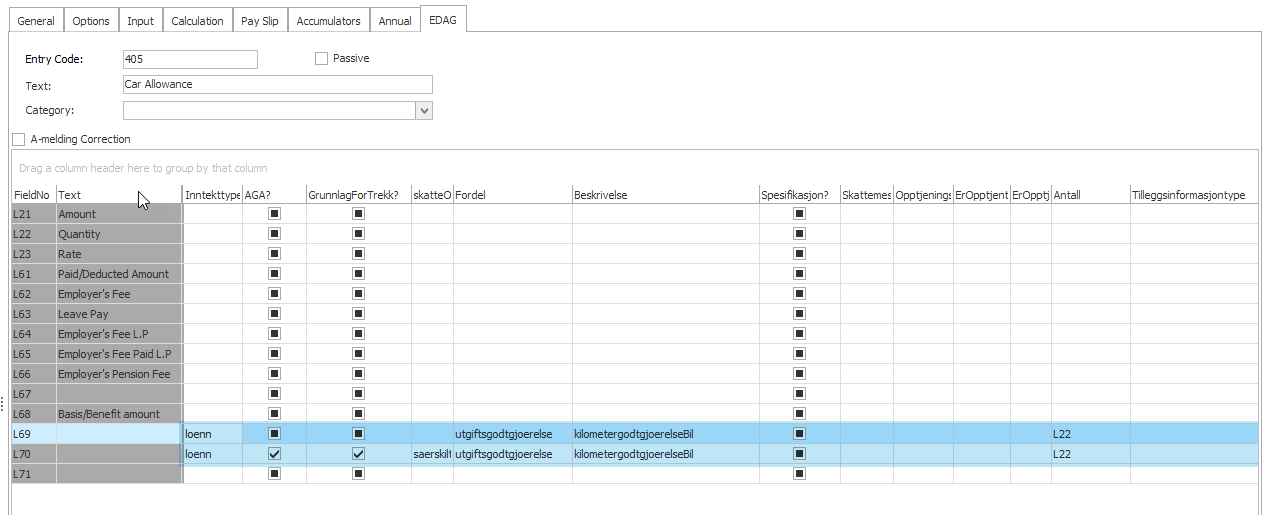

In this example, we are showing the kilometers (L22), the rate (L23), and the total amount paid out.  Set the following EDAG coding

This still refers to the non-taxable amount being stored in L69 , and the taxable amount in L70.

|

...

| Expand |

|---|

| title | Car Allowance (Commuter) / KM-godtgjørelse (Pendler) |

|---|

|

| Info |

|---|

Note: In our case, we use vessel rates 5 and 6 for the car allowance (Commuter).

But you may use different ones. |

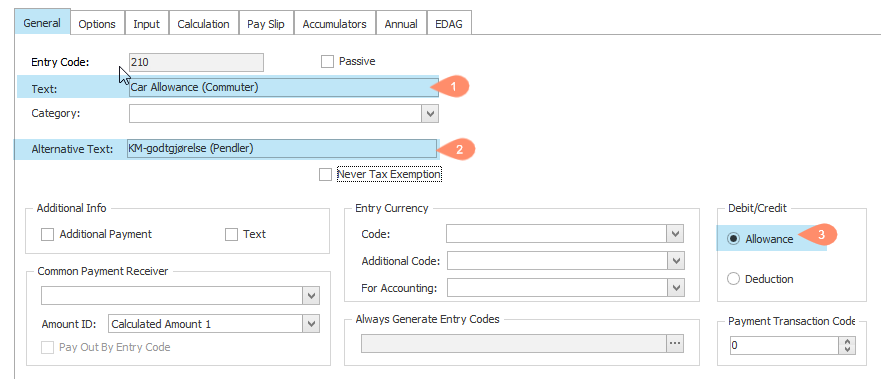

Under the General tab, fill in the entry Name and set it to Allowance.

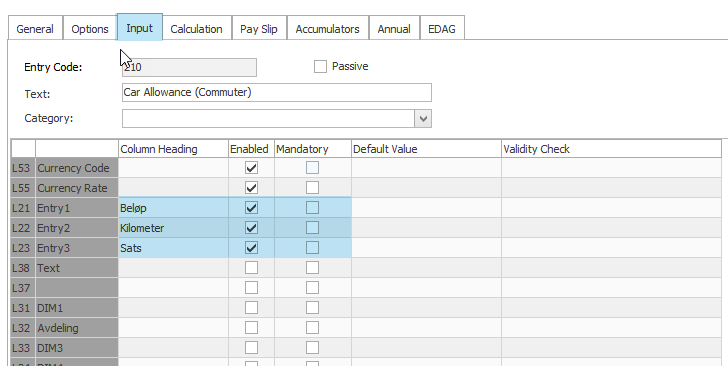

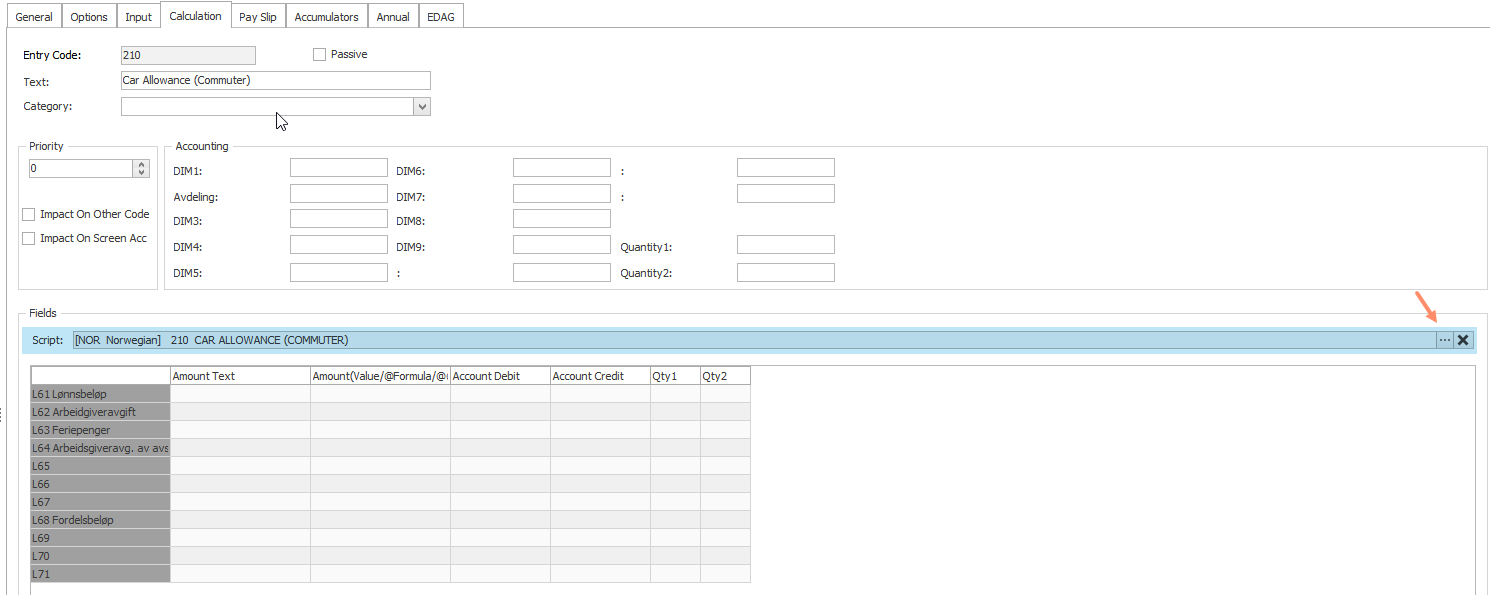

Under the Input tab, set up the following fields.  Under the Сalculation tab, define the necessary accounts and accounting dimensions.

Then create a separate script for the Car Allowance calculation.

This is an example of the script that you can create. Click here to learn more about the scripts.

In our case, we use global rates 21 and 22 for the calculation, and the non-taxable amount is stored in L69, and the taxable amount is stored in L70. . But you may use different ones.

| Code Block |

|---|

| //Setting Employer

//Here you need to add a line for calculating the employer organization

//e.g. @@ADD:007.

//You can check your other other entries for

//L23 - Input field 3 used for Rate

//VB5 = Vessel rate line 5 for max allowance rate

L23=VB5

//L61 - calculated amount 1

//L67 - calculated amount 7

//L22 - Input field 2 used for Kilometer

//L23 - Input field 3 used for Rate

//L21 - Input field 1 used for Amount

L61=L22*L23

L21=L61

L67=L21

//Calculation of taxable amount (Fordeling av skattepliktig beløp)

//VB6 = Vessel rate line 6 for non-taxable rate

//VB5 = Vessel rate line 5 for max rate

//(VB5-VB6) - taxable part

//L67 - calculated amount 7

//L69 - calculated amount 9

//L70 - calculated amount 10

IF VB5 > VB6 THEN

L70=(VB5-VB6) * L22

L69=L67-L70

ELSE

L70=0

L69=L67

ENDIF

//L62 - calculated amount 2

//W81 - accumulator for tax table

//P50c - Company rate for region

W81=W81+L70 //Taxable (Skattepliktig)

L62=L70*P50c //Employers fee |

Setup the fields to be available on the Payslip.  Set the following EDAG coding.

|